For a business owner the decision to sell your company can be a drawn out process. It is hard to know the best time to exit and even after you have decided you are almost guaranteed to second guess yourself a time or two. However, one thing that is virtually certain in this transaction is that at some point a potential buyer is going to want to see the facts, and by facts I mean all of your business documents.

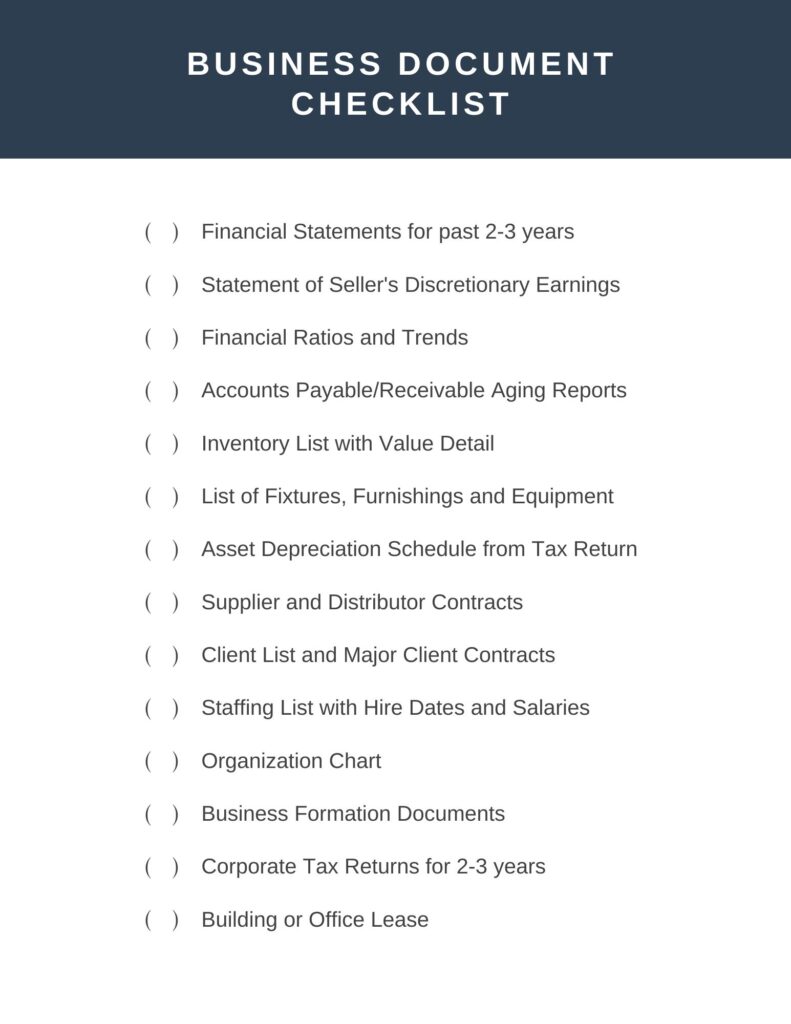

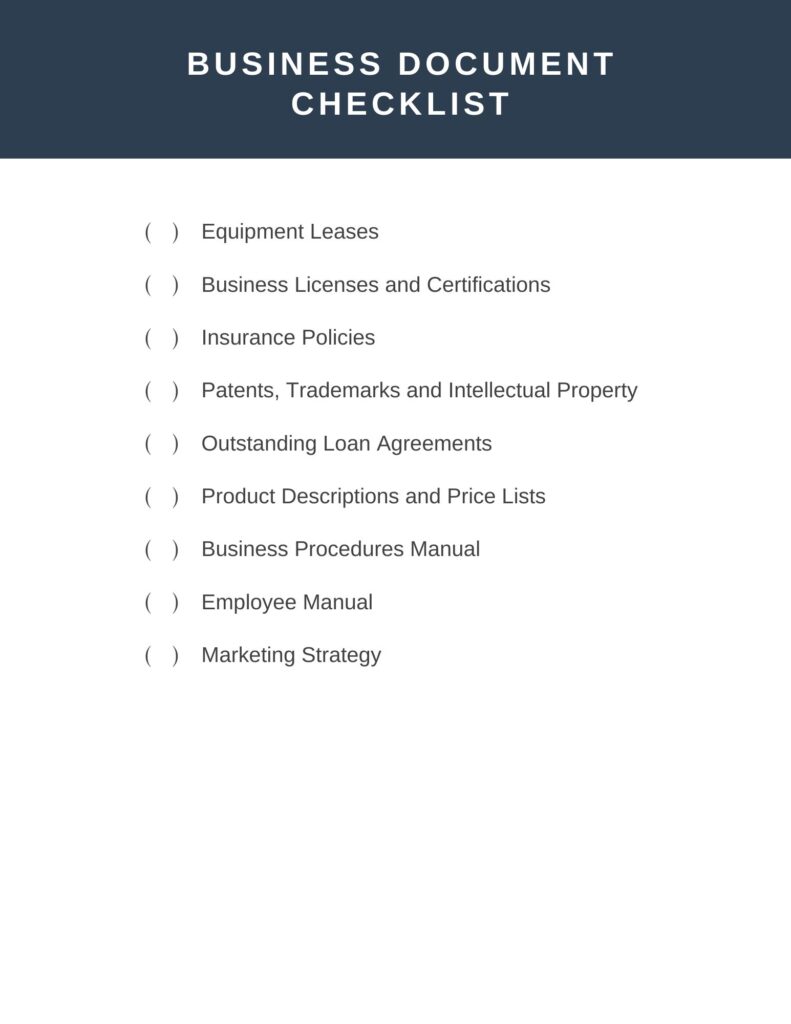

As a general guideline the main documents required when you are looking to sell your business include financial information, list of company assets, organizational chart with individual employee information, real estate documents, and client or supplier contract information.

There are obviously many more requirements, but the above examples cover the main categories a buyer will be looking at to determine if they want to acquire your company. My goal in this article is to provide a comprehensive checklist for business owners that when completed will answer the question of “What documents are required to sell a business?”.

Financial Documents Are The Most Important

In order to start the process of preparing to sell your business you’ll need to get all of your financial documents together for the past 2-3 years. This will include things like your financial ratios and trends, accounts payable and accounts receivable aging reports, and statement of seller’s discretionary earnings. Hopefully you have this information readily available to you, but if you are a bit unorganized, now is the time to get ready. Having your financials ready ahead of time allows you to easily begin working with a business broker or other professional advisor when you make the decision to sell your company.

Your business’s financial statements have to be organized in order to start the assessment process. You’ll typically have an introductory meeting with your chosen business broker and immediately after you’ll be expected to send over financials. From there your team along with potential lenders will begin determining a fair asking price for your business.

This is step #1 when preparing documents for the sale of your company. An agreed upon asking price and subsequent listing is a must before you can even begin attracting potential buyers. You have to give them something to buy after all, and without financial documents there is no way to determine the value of your business.

Some Basic Documents You Need To Have

The list of documents you need to have prepared when you decide to sell your business can seem endless. The truth is that the actual requirement depends on the nature of your business and the potential buyer you are dealing with. However, there are a few general categories that you need to consider a necessity.

Keep reading for a completely downloadable business document checklist for when you decide to sell your business.

Business Assets

To determine the value of your business you are going to need to provide documentation of all the assets associated with your company. This will include lists of fixtures, furnishings, and equipment, scheduled asset depreciation from tax returns, an inventory value list, and more depending on your business structure.

All of this is necessary to get an accurate picture of a fair market valuation. Often, the asset value in a business is rather small, there are minimal equipment needs for many office-based businesses and few main street companies own real estate of any kind. However, there are situations where a great deal of asset value is present within a company. A few key scenarios where you might see this are businesses that own their equipment, own instead of leasing real estate, or have a significant amount of money tied up in inventory.

Employee Information

Your employees are considered in the value of your business. Most of the time the buyer will want to keep them employed once they take over operations. Make sure you have all of your employee information organized and easily accessible. Everything from the business organizational chart to your individual employee benefit packages will need to be reviewed by your potential buyer.

Employees are the operational backbone of a company. The average buyer is intending to take over the day to day aspects of the business and will need to know who does what and how things work.

Client List

It’s all about the book of business. Having an up to date client list can really help solidify the value in your business. Your list of customers and key accounts is the difference between the buyer just starting their own business versus purchasing yours. They are investing in years of client acquisition and a proven track record of success.

If you primarily sell to consumers, the buyer may want to look at your client retention numbers along with an accurate list of total clients. They will likely even go further into your customer acquisition costs and sales cycle to see exactly how you are maintaining a flow of new clients.

Now for B2B companies a buyer may want to look at key accounts and account management practices. The strategies in place to keep business relationships are very important, especially with accounts that generate a significant amount of revenue. However, a reliance on another company for a significant share of yearly earnings may also be a red flag to potential buyers. The buyer’s main objective with looking at your client lists along with supporting data and documents is to determine the viability and value of your business. After all, clients equal revenue and revenue is what the buyer is looking for.

A Complete Checklist Of Documents Required To Sell A Business

Below is a comprehensive list of business documents you will need when you decide to sell your company. Essentially it is everything that contains information on your business. You will be required to provide all of these documents at various times throughout the process. Financial statements are needed first to get the process started and determine a satisfactory listing price for your business. The remainder of the documents on this checklist will need to be provided to the potential buyer’s team for due diligence.

Download a copy of this checklist so you can keep track of everything when it comes time for you to sell.

Click here to download

Conclusion: What Documents Are Required To Sell Your Business?

Short answer: Just about everything you can think of.

The process of selling your business can take a while and require a great deal of due diligence by all parties involved. You can make things easier by having all documents relating to your business organized and accessible. The reality of this process is that before someone will buy your company, they will need to know virtually everything about it.

Financial statements and assets are easy to understand due to the direct correlation to your business’s valuation. However, many buyers will also want to see things like marketing plans, employment agreements, and business licenses included among a list of documents unique to your entity. When the time does come for you to sell your business, make sure you have all of your information together. A little preparation can save you a great deal of time and stress.

My goal for this article was to shed some light on the scope of required information and hopefully motivate some of you to begin formulating an exit plan. If you have any questions about growing, buying, or selling a company feel free to reach out here.